By Fred Magdoff

The monetary hindrance has created a bunch of difficulties for operating humans: collapsing wages, misplaced jobs, ruined pensions, and the anxiousness that includes no longer realizing what the next day willbring. Compounding all it is a loss of trustworthy info that speaks to the realities of staff. Commentators and pundits appear extra careworn than a person, and economists—the so-called "experts"—still hold to bankrupt ideologies that did not expect the problem and supply not anything to give an explanation for it.

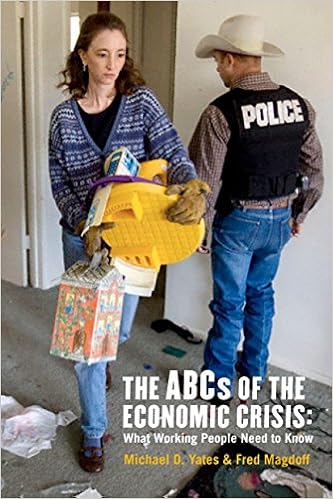

In this brief, transparent, and concise ebook, Fred Magdoff and Michael D. Yates clarify the character of the commercial predicament. opposite to traditional knowledge, the authors display that this trouble isn't a few aberration from a usually benign capitalism yet fairly the conventional or even anticipated end result of a completely irrational and damaging method. No volume of tinkering with capitalism, no matter if it's discredited neoliberalism or the go back of Keynesianism and a "new" New Deal, can conquer the center contradiction of the approach: the day-by-day exploitation and degradation of nearly all of the world’s humans by way of a tiny minority of commercial owners.

While the present financial maelstrom has laid naked the internet of greed, corruption, and propaganda which are primary to capitalism, in basic terms an aroused public, difficult the proper to wellbeing and fitness care, good employment, a safe outdated age, and a fresh and fit surroundings, can lead the us and the realm out of the worst challenge because the nice melancholy and towards a procedure of construction and distribution conducive to human happiness. This publication is aimed essentially at operating humans, scholars, and activists, who wish not only to appreciate the realm yet to alter it.

Read Online or Download The ABCs of the Economic Crisis: What Working People Need to Know PDF

Similar economy books

Financial Fundamentals for Engineers

Engineering potential thrifty use of assets (labour, energy, and materials). cash is the typical degree for those despite the fact that engineers are hardly taught how the realities of finance and economics will effect at the engineering judgements they make. monetary basics for Engineers units out to teach how finance interacts with engineering and why it issues.

The Law of Corporate Finance: General Principles and EU Law: Volume II: Contracts in General

During this three-volume publication, the legislations of company finance is outlined in a latest method and studied from the viewpoint of a non-financial enterprise. The legislation of company finance is helping the enterprise to regulate funds move, hazard, principal-agency relationships, and data within the context of all judgements that impression the firm’s funds.

This book gains policy-oriented learn papers and articles providing insightful perspectives and knowledge on local comparative analyses and nationwide top practices on alternate and funding coverage concerns for the Asian and Pacific area. It covers such salient concerns because the internationalization of creation networks and local monetary cooperation for the rehabilitation of tsunami-stricken nations.

- Issues in Islamic Banking: Selected Papers (Islamic Economics Series)

- Economic Justice

- The Ethics of Accounting and Finance: Trust, Responsibility, and Control (National Conference on Business Ethics Proceedings)

- Financial Analysis Using Excel Brealey Myers

Extra resources for The ABCs of the Economic Crisis: What Working People Need to Know

Example text

On the other hand, the poorest 20 percent of the population saw their average after-tax income increase by only 6 percent$800-during the same period. The change of income distribution over time has been pretty dramatic. In 2006, the top 10 percent received close to 50 percent of all income in die United States, up from about 33 to 35 percent for most of the period from 1940 to die early 1980s (Figure 2). Wealth distribution also changed gready dur- ing this period, and by 2004, die top I percent owned about one-diird of all the net worth (wealth minus debts) in the United States, with die top 20 percent controlling 85 percent of the net worth (Table 4).

Everybody was buymg die pig in the poke. But they were buying die pig it die poke widi a pretty pink ribbon, anil the pink ribbon said. " Bodi political parlies helped create the environment tliat allowt . widespread fraud to occur. Clinton favored deregulation as much Bush. What is more, the people President Obatna l»s put in charge fixing the mess are, for die most part, the very same persons who peqi tratcd the fraud. They arc doling out money to the same banks and liuai cial companies who were dieir partners in crime.

5 million extra jobs that should have been created each yearjust to keep up with the number ofpeople coming ofage and wanting to enter the labor force, minus those leaving because ofretire' mt nt. 4%, including part time workers diat want full time jobs and people who have given up looking for work (and therefore aren t considered ' unemployed) brings the total to I9%-or approximately 30 million people. As we write this book, some economists are pointing to green " " shoots of positive news that indicates that the worst might be over.